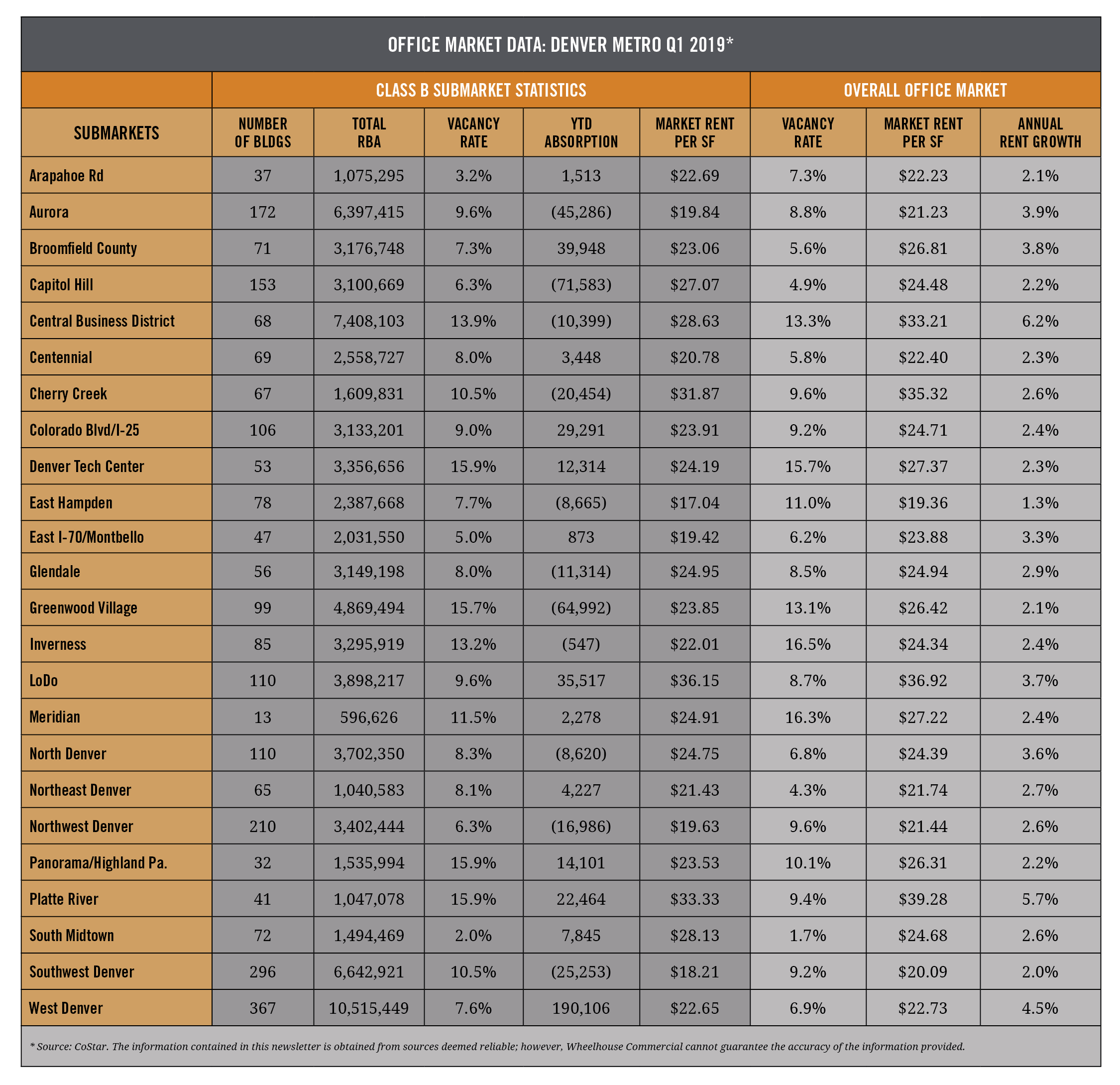

As part of our continuing effort to bring our readers relevant and concise market information, we have compiled and analyzed the most recent office market data for the last quarter. The table and graphs below report some of the key market indicators of the Class-B office market, and overall office market (Class A, B, & C), in 24 submarkets across the metro Denver area.

Market Rents

The Metro Denver office market continues to trend positively during Q1 2019. Market rents for Class-B product ranged from $17.04 full-service gross (fsg) along the East Hampden corridor, to over $36.00 fsg in LoDo. Every submarket we track maintained positive year-over-year rent growth (for Class A-C properties) ranging from 1.3% (East Hampden) to 6.2% (CBD). Rent growth in the CBD has been extremely strong for the past two years and has rebounded completely from the oil-and-gas downturn in 2015/2016. The Platte River submarket, which contains the RiNo District, is experiencing strong rent growth due to the influx of top-tier, new-construction deliveries.

Vacancy

Vacancy rates also continue to be considered very ‘healthy’. Vacancy for Class-B product, range from 2.0% in South Midtown submarket to 15.9% in the Platte River and the Panorama/Highland Park submarkets. It should be noted that in all three of these markets, vacancy rates dropped again from the last quarter (Q4 2018). In other words, submarkets that were already tight are getting tighter; and submarkets that seemed to have relatively high vacancy, mostly due to construction deliveries, have absorbed the new product. With the amount of new construction delivery that has occurred over the past 5+ years of this cycle, it is difficult compare and analyze submarket vacancy (and even rents) against one another.

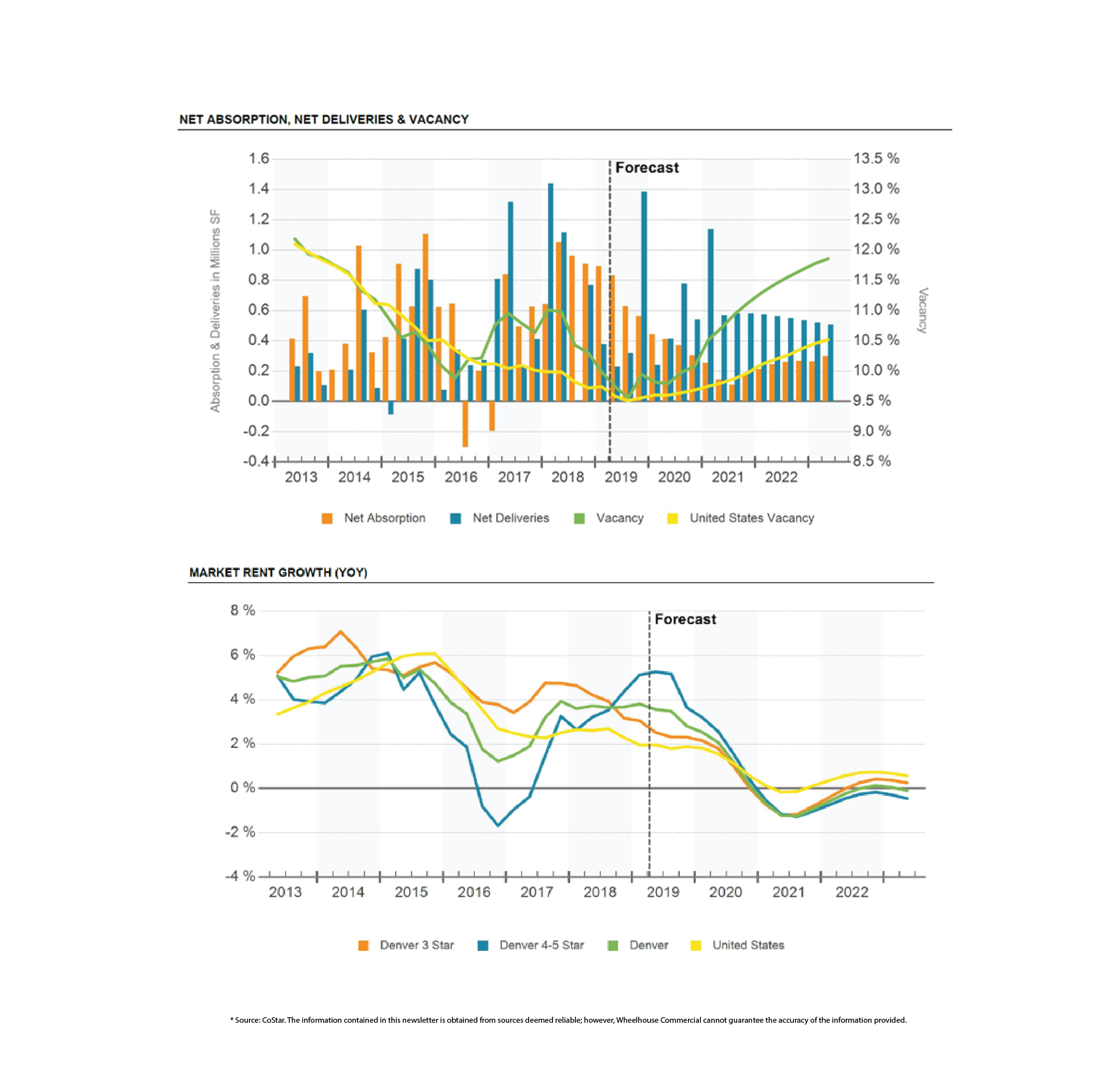

Forecast

A large amount of new office deliveries are expected in late 2019 and early 2020. CoStar analysts believe that in Q1-Q2 next year, vacancy will begin to increase fairly rapidly from a low-point in the current cycle of 9.5% market-wide, to nearly 12.0% by mid-2023. As naturally follows, market rent increases will begin to flatten, then decrease, and may turn negative at the end of 2020. Considering that we are currently flirting with the longest economic recovery in U.S. history, this scenario seems very plausible.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.