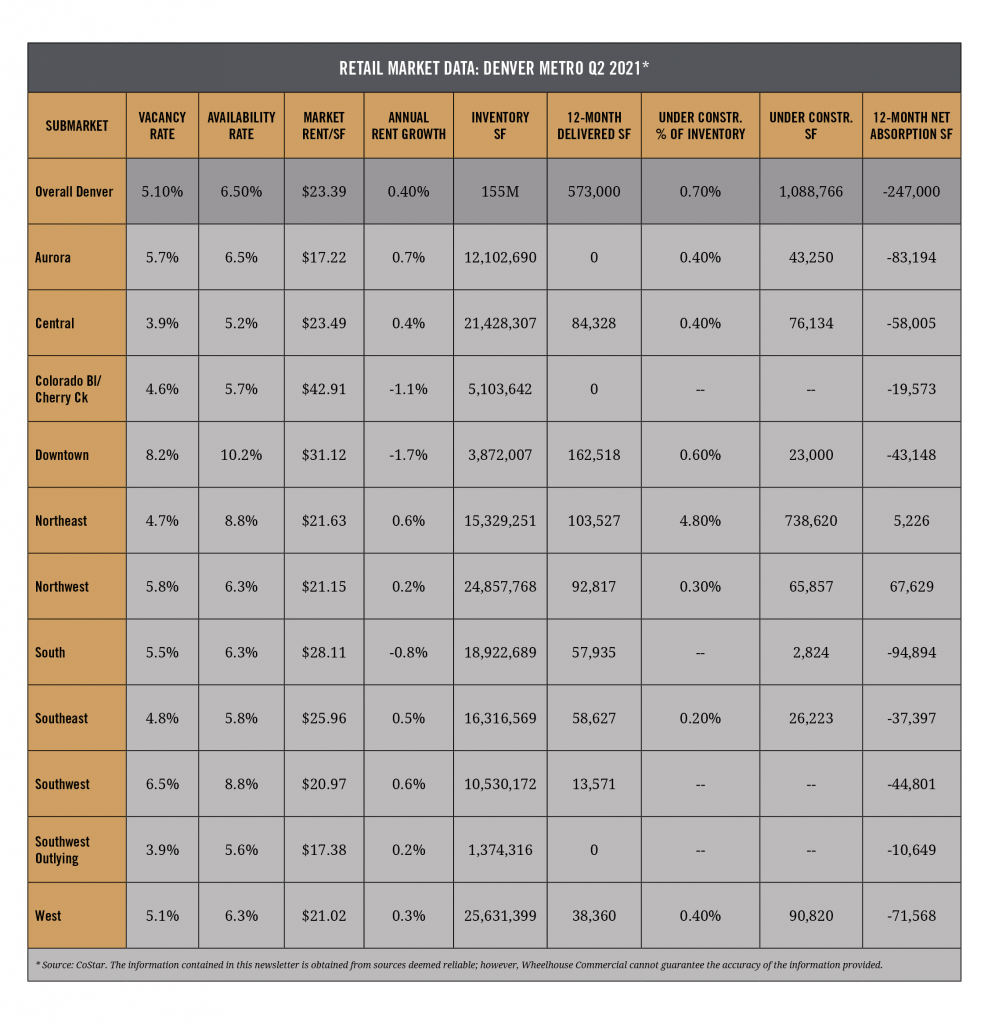

Wheelhouse Commercial has compiled and analyzed the most recent retail market data from the last quarter. The table below reports some of the key market indicators from submarkets across the greater Denver retail market, during Q2 2021.

Overview

Given the turmoil wrought on retail businesses over the past 17 months, we were anxiously awaiting the Q2 2021 retail market metrics. Now that life is maybe returning to normalcy and businesses have fully re-opened, what damage did COVID inflict on the retail real estate sector? While many businesses failed (some nationwide estimates are 30% – 40%), and most struggled and only managed to survive with the aid of the Paycheck Protection Program, the Denver retail real estate market seemed to fair quite well.

Vacancy & Absorption

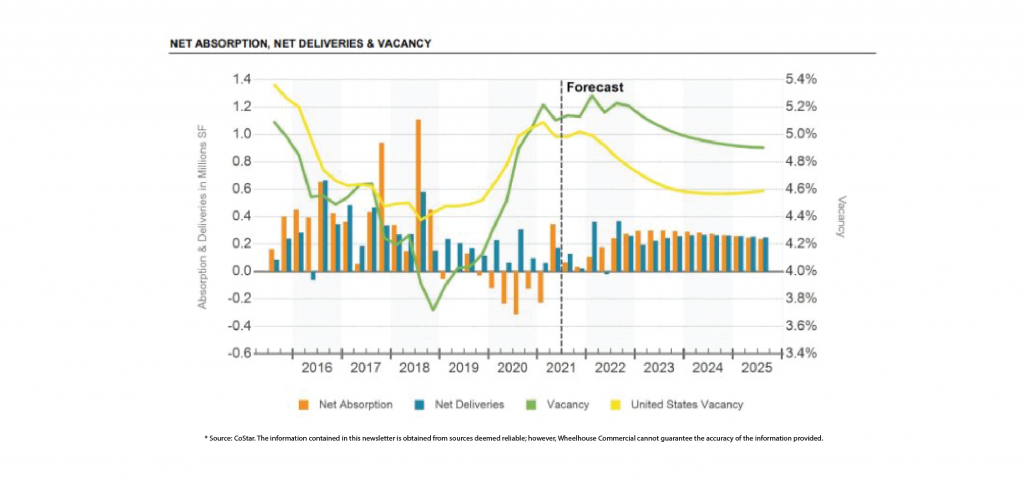

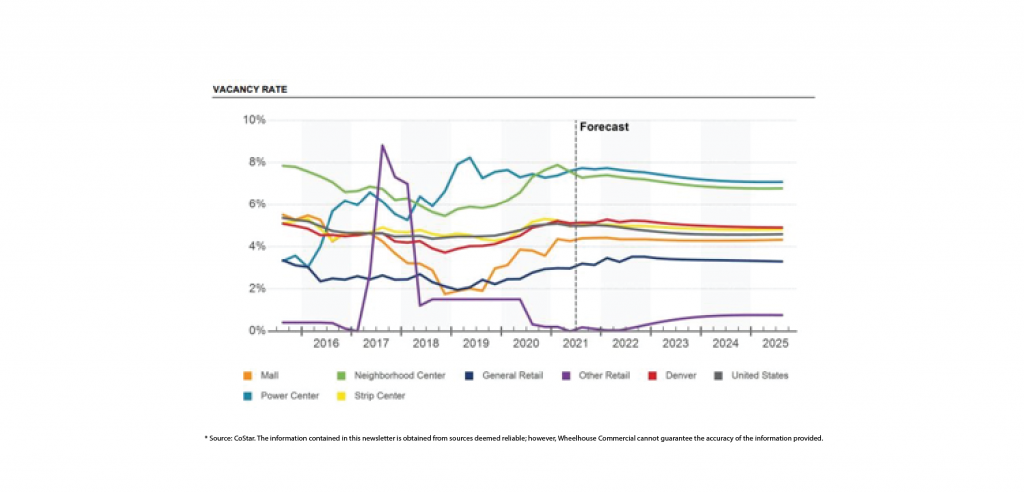

After a historic run of over 10 years of declining vacancy and positive absorption, the market, not surprisingly, turned. Vacancy had reached an historic nadir of 3.72% at the end of 2019. It then only rose to 5.21% at the end of 2020, and is currently about 5%. This level of vacancy is considered “healthy”, and given the circumstances, is quite amazing. Vacancy is expected to remain at this level for the next few years.

Denver recorded a slight negative absorption in Q4 2019, and then continued for another five quarters, its longest streak of negative absorption in history. However, it turned positive in Q2 2020 and is expected to remain positive for the foreseeable future.

Market Rents & Growth

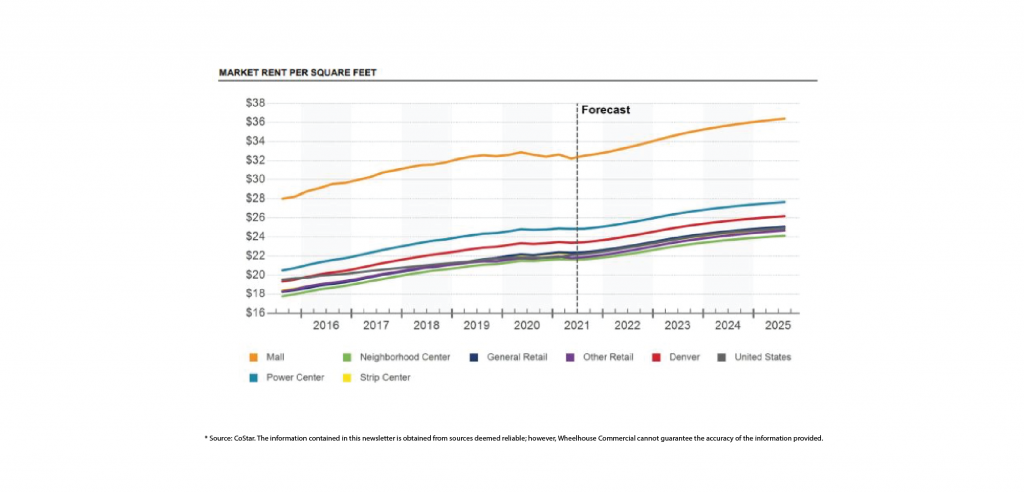

As follows strong vacancy and absorption, market rents also increased steadily for the past decade. Surprisingly, market rents did not see a very measurable decline in the past six quarters; they were at $23.16 psf in Q1 2020 and currently sit at $23.39 psf. Of course, this means that market rent growth has been just slightly above zero. Denver has not realized negative retail rent growth since 2011! The expectation is for rents to begin to steadily increase, with a significant surge in rent growth in 2022.

Conclusion

Prior to the pandemic, CoStar consistently named Denver among the top, if not the top, retail markets in the nation. Considering the struggles of the past year, the fact that vacancy only increased slightly and market rents remained stable, Denver has proven that it truly is a resilient retail market and will remain so into the future.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.