Denver’s population growth, robust employment and overall economic health have made its retail market one the strongest performing markets in the nation, and by some measures, the best performing in the nation.

Market Rents

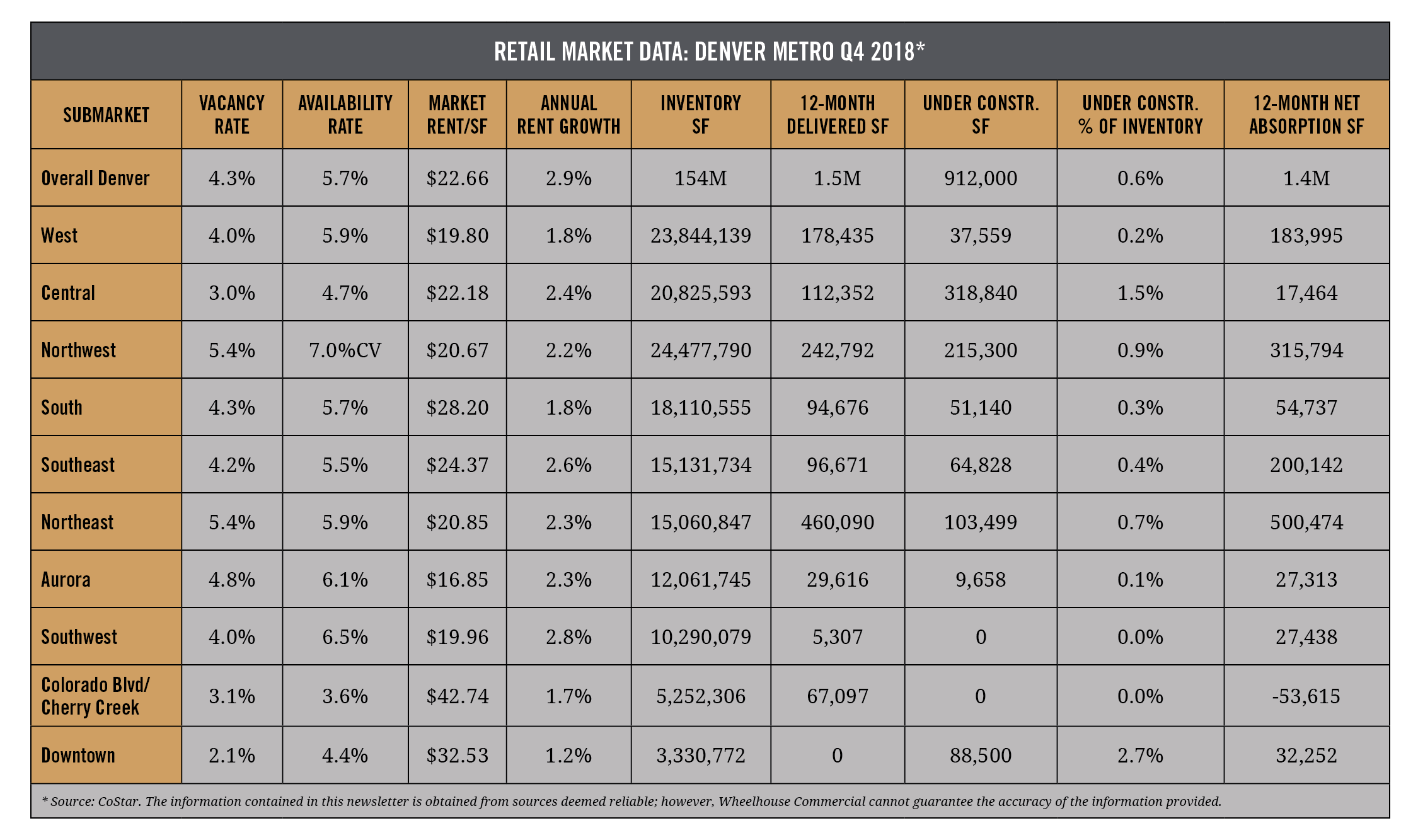

Retail rent growth has slowed somewhat compared to the past years of this cycle. Every retail submarket we track sustained year-over-year positive rent growth, ranging from 1.2% to 2.9%, which is still quite impressive considering that the Denver market has led the nation with an average rent increase of 5% annually over the past five years. Every market forecast that we track predicts that retail rental rates will continue to rise in 2019 in the 1-2% range; though not the torrid pace of past few years, still impressive.

Vacancy

As would be expected by the increase in rental rates, vacancy remains very low in the Denver retail submarkets, ranging from 2.1% to 5.4%. In fact, the overall market vacancy rate of 4.3% is the lowest in the last 15 years. The low vacancy is not only being driven by demand, but also by a relatively low supply of new retail construction. As many observers have recognized, much of the available land for development has been snapped up by apartment developers during this last cycle.

Economy

As has been reported consistently for the past several years, the Denver economy remains one of the strongest in the nation with low unemployment rates and favorable job creation figures. What has changed recently is that Denver is finally experiencing wage growth. Since recovering from the Great Recession, it has been widely reported that Denver’s wage growth has lagged behind other expanding markets, and, coupled with dramatically increasing housing prices (both for rent and for sale) has made for a very unaffordable place to live. However, starting in 2018 wages began to surge ahead of the national average. This is favorable for the retail sector as residents should have more disposable income.

The table below reports some of the key market indicators of the retail property market, across 10 submarkets and the metro Denver area.

The information contained in this article is obtained from sources deemed reliable; however, Wheelhouse Commercial cannot guarantee the accuracy of the information provided.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.