In May of 2019, Colorado property owners received their property assessments of value. As was the case in 2017, the increase in values stunned many commercial property owners; these assessments will likely lead to hefty increases to their property tax burdens in 2020. Individual counties will establish mill levies later in the year and will send property tax statements in December or January. But really, anyone who has been following the real estate market the past 5+ years should not have been shocked.

In May of 2019, Colorado property owners received their property assessments of value. As was the case in 2017, the increase in values stunned many commercial property owners; these assessments will likely lead to hefty increases to their property tax burdens in 2020. Individual counties will establish mill levies later in the year and will send property tax statements in December or January. But really, anyone who has been following the real estate market the past 5+ years should not have been shocked.

These property tax hikes may be coming at an inopportune point in the real estate and economic cycles. Now is the time to consider the effects that these operating cost increases may have on your property, and your tenants, and formulate a plan to deal with the increase.

The Timeline

Sales comparisons used to establish property values for this current period were for sales that closed prior to June 2018. The next assessment will take place in June of 2020, only 10 months away. The final property tax amounts from the 2020 assessment will affect the property tax bills that are payable in 2022 and 2023. With sales prices and volumes continuing to escalate across all product types, it seems likely that we will be faced with another round of increased property taxes a few years from now. So, we will have realized six years of double-digit (and sometimes more) in tax increases; as we will see below, these increases can have profound impacts on operating expenses and ultimately a property’s NOI.

The deadline to file regular administrative appeals for this year was June 1, and many county Board of Equalization appeals were due on July 15. The appeal process is a topic for a separate article; however, the consequences of these tax increases will be significant for both landlords and tenants. Strategies must be implemented to help mitigate the pain of operating cost increases that are coming this year, and most likely in the following few years.

Commercial Tax History and the Current Market

In Colorado, property taxes are influenced significantly by the Tabor Amendment and the Gallagher Amendment. Volumes have been written about these voter-approved spending bills and the effects that they have had on commercial property taxes. In summary, these measures have resulted in commercial property bearing a much heavier tax burden in Colorado than residential properties. Since Gallagher was enacted in 1982, the residential assessment rates have been slashed from 21% to 7.2 % today, while non-residential property is assessed at 29%, over four times the residential rate (apartments are considered residential). And, with no caps on property tax increases, which many states have, the result has been astronomical tax increases during this past positive economic cycle. Efforts are underway to try to unravel these laws, but for now, they stand.

Commercial property values are primarily assessed using the sales comparison method. The sheer volume of properties that have traded over the past five years, at ever-increasing prices, makes the assessors justification of increased value pretty cut and dried. It’s a safe bet that within a few blocks of your property, a very similar building has traded at a seemingly exorbitant price.

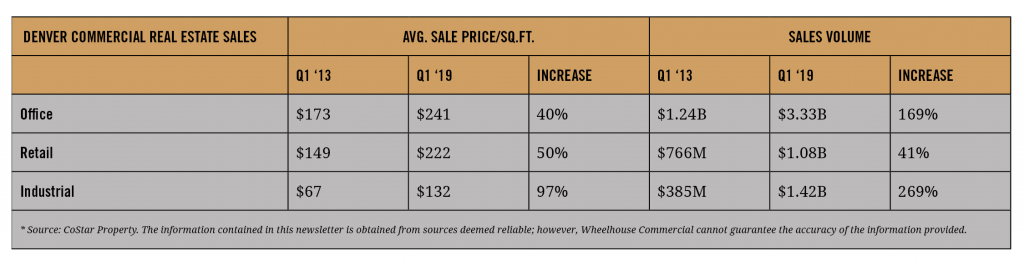

Below are a few Denver commercial real estate sales figures:

As a result of this hyper-active real estate market, double-digit tax increases were the norm during the 2016 valuation. Many properties that did not see a large increase during that assessment most likely saw them with this latest valuation. Some increases have truly been astronomical. Following are a few property tax and valuation increases from buildings in our management portfolio:

- A 63K sq.ft. office building in Golden

Property taxes nearly tripled (191%) from 2017 to 2018, based upon the sale price. Property taxes now account for 37% of total operating expenses. - A 34K sq.ft. retail center in Northglenn

Property taxes increased by 82% from 2017 to 2018. Property taxes now account for 49% of total operating expenses. - A 20K sq.ft. office building in central Denver

Property valuation increased 131% between the 2016 and 2018 assessments. If the protest is unsuccessful and the mill levy remains nearly the same, the 2019 taxes (payable in 2020) will account for over 50% of total operating expenses.

The Effects

These tax increases have, and will continue to have, a profound effect on both landlords and tenants. If your existing leases are triple-net, the property taxes will pass directly through to the tenant. The same is true for most modified-gross leases, whereby the tenant pays only the increase in expenses over the base year. In these cases, when the base year was established can dramatically affect how much of the tax increase the tenant will bear. While these types of leases offer the landlord protection against dramatically escalating costs, many small businesses operate on slim margins. Property tax increases, coupled with the increase in insurance costs due to wind and hail claims, will directly cut into small businesses’ profit margins.

These increases are happening during what most economists believe are the very late stages of the longest economic recovery in U.S. history. In other words, a downturn seems imminent and historically speaking, extremely likely. The result could be a perfect storm for small business owners, resulting in decreased profits and increased costs; the ultimate unfortunate result would be an increase in tenant defaults. And thus, even with triple-net and modified gross leases, the property taxes can become the owner’s burden.

Mitigation Strategies

What can an owner do to mitigate the effects of property tax increases, specifically loss of income due to increased vacancy?

Financial Analysis

The first step is to perform a sensitivity analysis. Revisit the long-term financial model of your property and also this upcoming years’ (2020) operating budget. The sensitivity analysis should focus on finding one critical number—your break-even point. This number will help determine what level of vacancy your property could handle, and what rent concessions you can offer if your tenants get into financial trouble. For small businesses, rent is one of the largest single expense items, especially for office users. If belt-tightening time comes, you don’t want your space to be the first item they slash. Rent reductions may provide better outcomes than vacant spaces, especially in a down market when it’s difficult to re-lease.

Leasing Strategies

Make sure any new leases or renewals you sign protect you against tax increases. Operating expense pass-through structures are often a lease negotiating point. While it’s possible to forecast a simple 3% or rate of inflation increase into your future operating expenses, the tax increases could drive those expenses exceedingly higher, as they usually make up the largest single above-the-line expense. As a property owner, you are likely more sophisticated than your tenant or prospective tenants regarding property tax implications; use that to your advantage. Your triple-net or modified-gross leases should be written in a way that passes along the increased taxes to the tenant. Do not allow caps on non-controllable expenses, especially taxes and insurance. Also, when negotiating renewals and extensions, do not re-set the base year to the current year.

Of course, with gross leases the landlord bears the entire burden of the tax increases. This additional cost negatively affects NOI. Landlords are also exposed if they have negotiated triple-net leases with caps on operating expenses that include non-controllable expenses, of which taxes and insurance are normally included. No matter how your leases are structured, as an owner, you are vulnerable to varying degrees.

Stay Informed

Periodically review your county assessor’s website, as most of these sites now provide a wealth of information. The Denver County website, for instance, has tabs for “Comparable Properties,” and “Neighborhood Sales”. Track local transactions to determine how much nearby properties increased in sales price, and then extrapolate your future assessed value. Your calculations won’t be perfect, but can estimate future tax increases and provide clearer optics into your local submarket.

Communicate With Tenants

Your management company should be proactive in communicating tax increases to the tenants. In March or April, management should provide tenants with new estimated CAM charges (including tax increases) for the upcoming year. During the January 2018 increase, Wheelhouse Commercial sent out a preemptive letter in January to tenants in buildings with upcoming significant tax increases. We also included a tax increase explanation in the cover-letter with the estimated CAM charges (with the reconciliation), in March.

The goal is to open up the lines of communication between ownership and tenants. It’s also a goodwill gesture that signals you care, and are not so insensitive as to suddenly slap them with large rate increase, especially if you knew months in advance. This goodwill could come in handy during lease negotiations. If a tenant is getting into financial trouble, it’s best to be forewarned so that you can be pro-active. Armed with updated financial models, you can make informed decisions regarding offering concessions, or not passing along the tax increases.

Summary

In summary, significant Colorado property tax increases, if they have not already been realized, will almost certainly occur in the next few years. It seems probable that we will head into an economic contraction period soon. This convergence of forces could spell trouble for both landlords and their tenants in the future. Now is a good time to plan for the implications by revisiting your property’s financial performance and strategy. Ensure your leases provide you with the utmost protection, and communicate with your tenants to allow you time to make sound decisions.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.