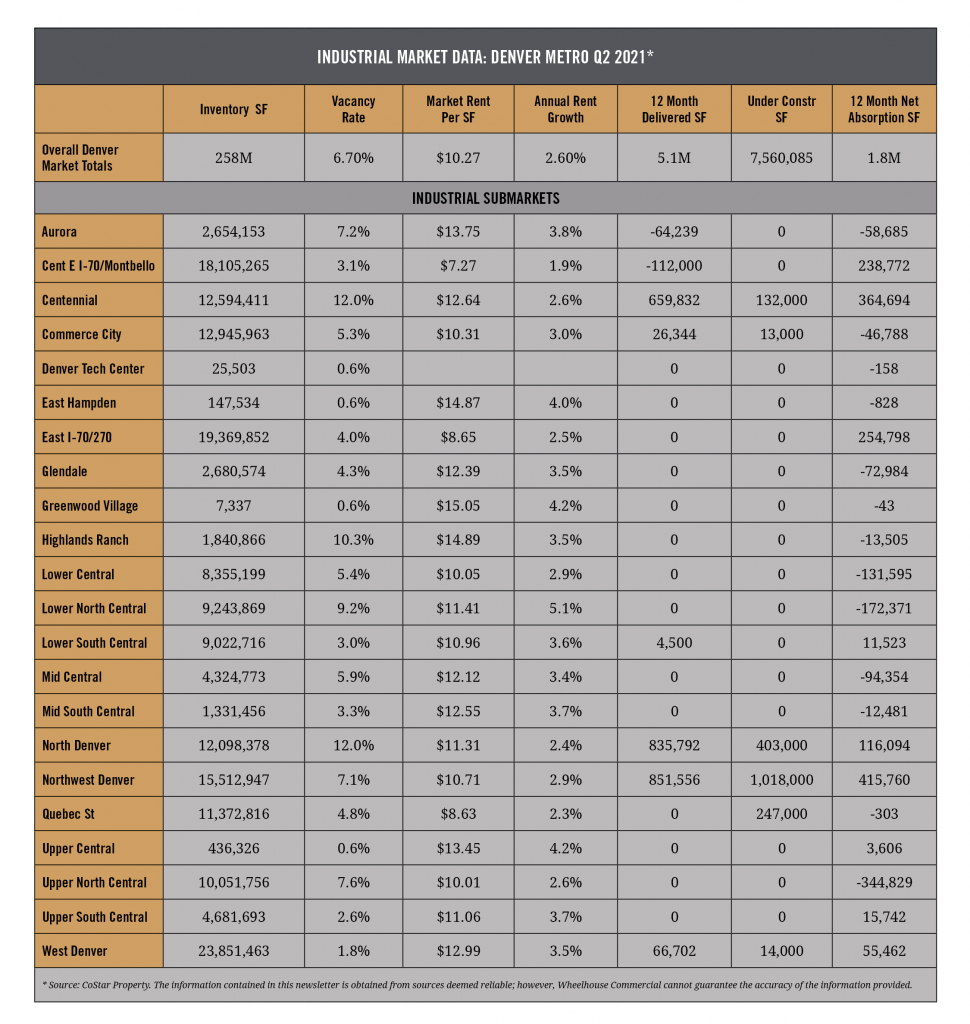

Wheelhouse Commercial has compiled and analyzed the most recent industrial market data from the last quarter. The table below reports some of the key market indicators from submarkets across the greater Denver industrial market, during Q2 2021.

Overview

The Denver industrial market remains very strong in the country and was arguably the best performing commercial real estate market segment throughout pandemic. Increased e-commerce continued to drive demand for large warehouse/distribution space and has spurned the development of very large speculative projects as well.

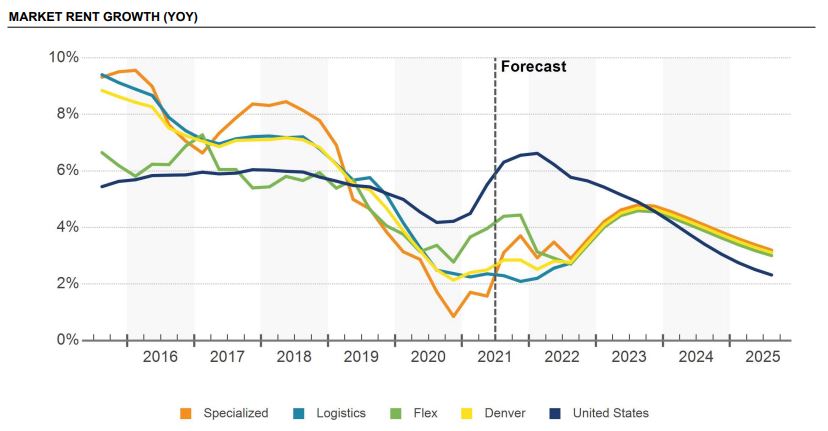

Industrial Market Rents

Annual industrial rent growth did pull back a bit to 3.2%. Rents growth was very impressive from 2016 to 2018, remaining above 7% annually for that entire time, however, rent growth began to decline in 2019, before the pandemic. The pullback was most likely due to the delivery of speculative projects beginning in 2019, with over 14 million square feet completed between 2019 and 2021. Another 8 million square feet is expected to be delivered in the next year. The forecast is for rent growth to remain at the 2.5% – 3% level for the next two years and then begin to pull back, but remain positive.

Again, it should be noted that nearly all of the new construction is of the very large logistics/distribution warehouse type, with very little small-scale and flex space supply coming online. As evidence of the deal sizes that are currently taking place, CoStar reports that tenants signed 29 leases over 50,000 SF year-to-date. Smaller tenants looking for space have very few options, so the power remains with the Landlords in these sectors.

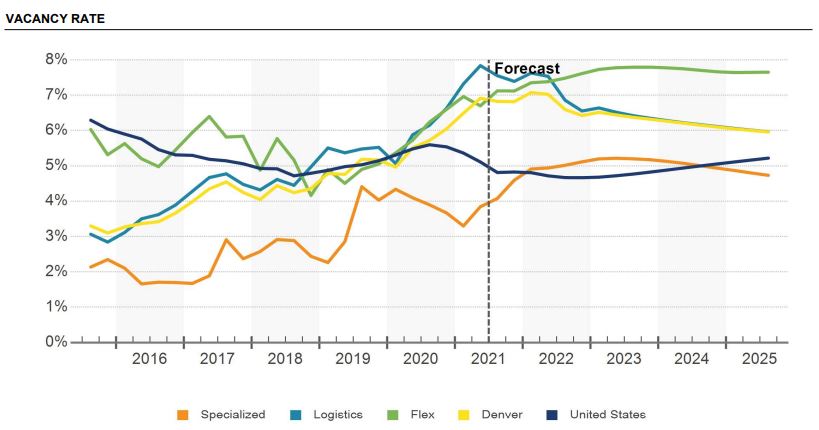

Industrial Vacancy

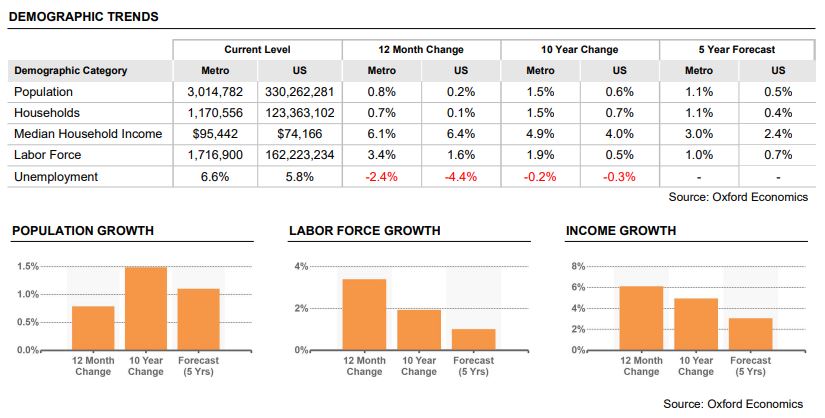

Vacancy did climb a bit to 6.4% in the second quarter of 2021. However, as noted above, the slight increase is most probably due to the high volume of construction deliveries. Vacancy began to plummet in 2013, much of it driven then by the legalization of marijuana, and then remained below 5% for six straight years. Industrial vacancy is expected to remain in the 6% range for the foreseeable future as Denver’s overall economy is expected to remain very robust.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.