The Denver industrial market remains one of the hottest in the country; our strong local economy driven by employment, retail sales, industrial production, and yes, marijuana production, have coalesced to continue to drive unprecedented demand deep into this current recovery cycle.

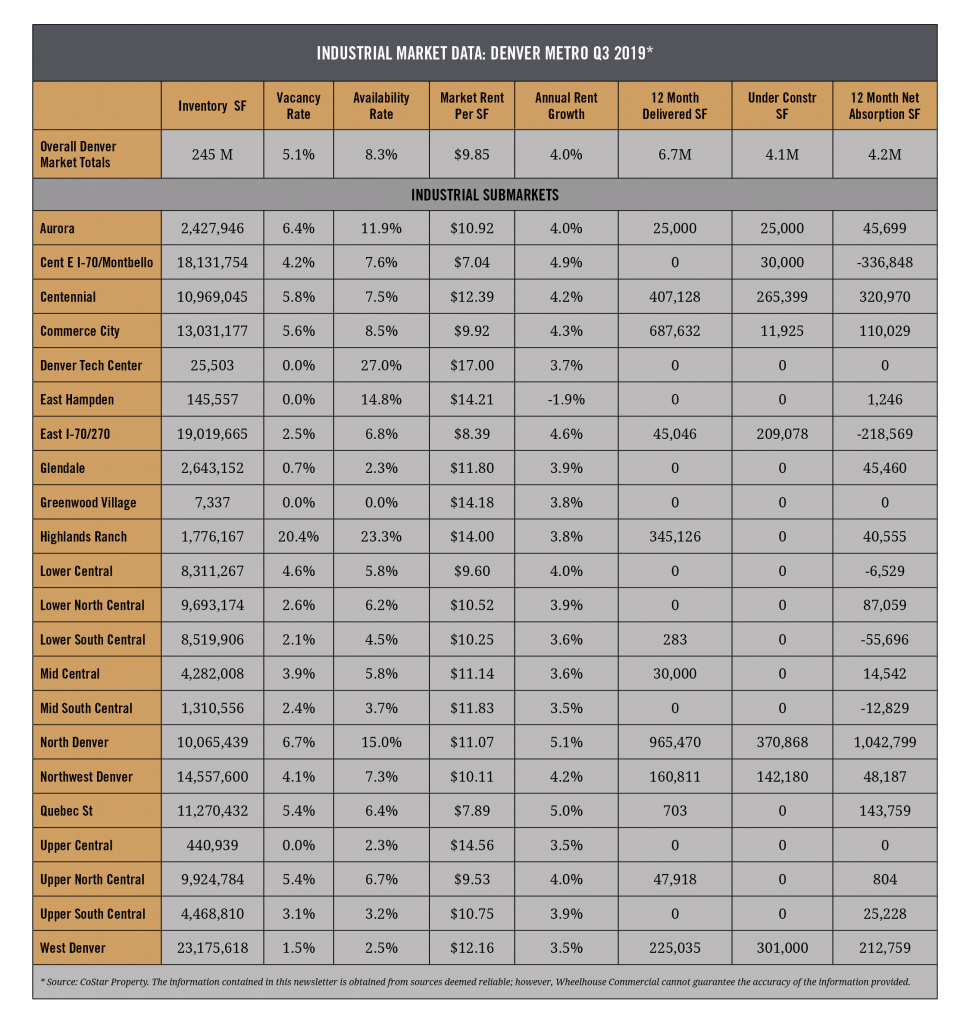

The table below reports some of the key market indicators from 22 submarkets across the greater Denver industrial market, during Q3 2019.

Market Rents

Industrial rents continue to grow at the very healthy rate of 4% annually. Rents have increased nearly 60% since the peak of the last cycle, making it the third best performing market in the country, trailing only San Francisco and San Jose. However, rent growth has slowed significantly over the past year, from 7.8% in Q3 2018 to 4.02% in Q3 2019.

This is the first significant drop in rent growth since the market began its precipitous rise in early 2012, peaking in 2015 at 9.7%. Since that time, rent growth has slowly declined and hovered in the 7-8% range. It should be noted though that rent growth is still positive.

While new construction is also at a peak in the cycle, with over 5 million sq. ft. currently under construction, nearly all of the new construction is of the very large logistics/distribution warehouse type, with very little small-scale and flex-space supply coming online.

Smaller businesses looking for industrial space have very few options, so the power remains with the landlords in these sectors.

The forecast is for rent growth to remain around the 4% level for the next year, and then to begin to taper down to 1% annually through 2022.

Vacancy

Vacancy rates remain very low at 5.1%. While they have come up about 2% since their nadir in mid-2015 (the end of the mad-rush for marijuana grow space, most-likely) they are still at very tight levels, especially for smaller and flex space. The availability rate is at 8.3% market-wide.

There are a few submarkets with very high availability rates (Aurora, Highlands Ranch, and North Denver), but note that these are markets that seen recent significant deliveries/construction activity.

The forecast is for vacancy to grow marginally (less than .5%) over the next few years.

Economy

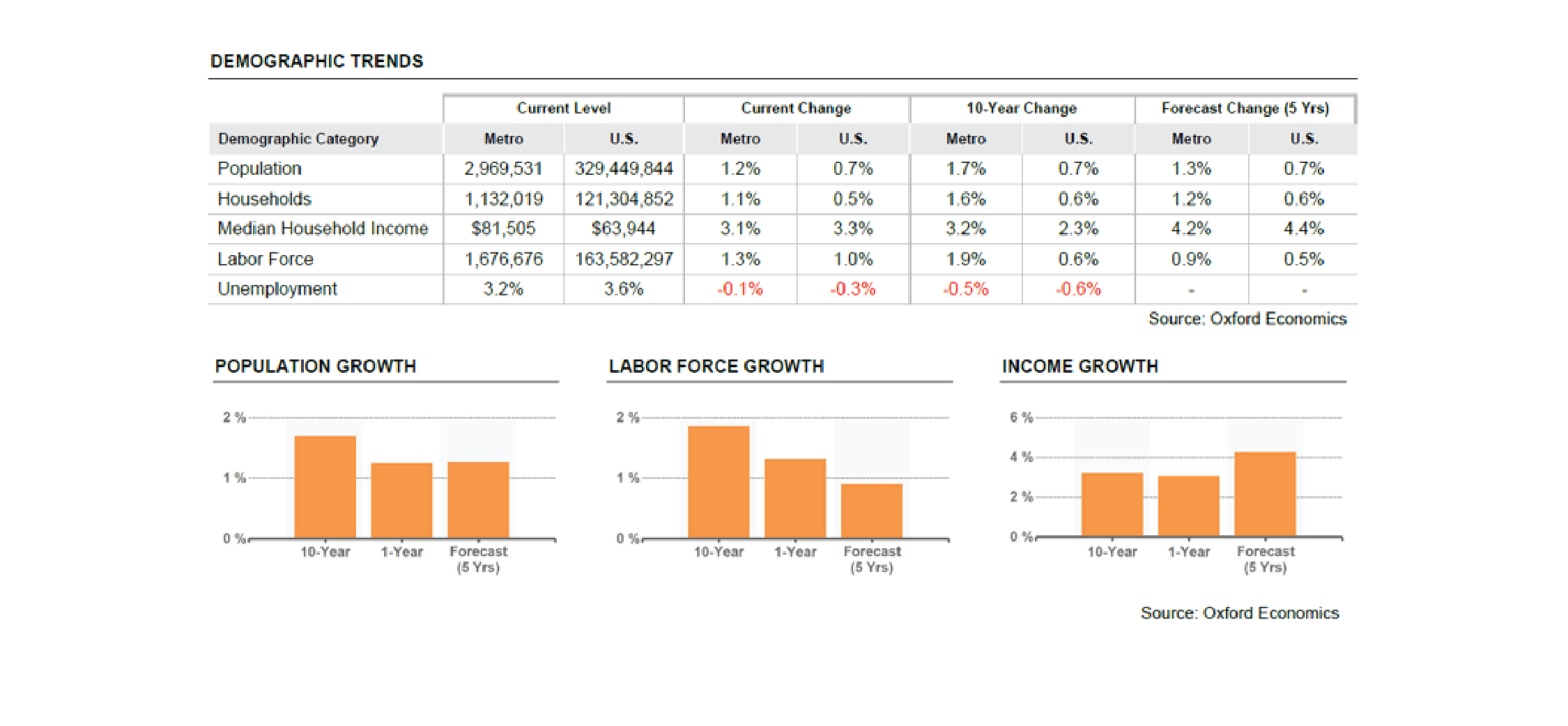

As is widely known, the Denver economy is still booming. Employment growth has continued to increase, but is now at 1.5% as compared to 3% in 2018. The Metro unemployment rate, at 3.2 %, is effectively full-employment. The most significant development recently is that the tight jobs market has finally resulted in wage growth in the past year and a half. And as can be seen below the metro household income is expected to keep growing at an even faster pace.

Summary

The Denver metro industrial market, like every other commercial and residential real estate segment, has continued its long run (over five years) of significant gains. Due to the fundamental strength of our local economy the forecast is for the market to remain strong, albeit at a more tempered pace.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.