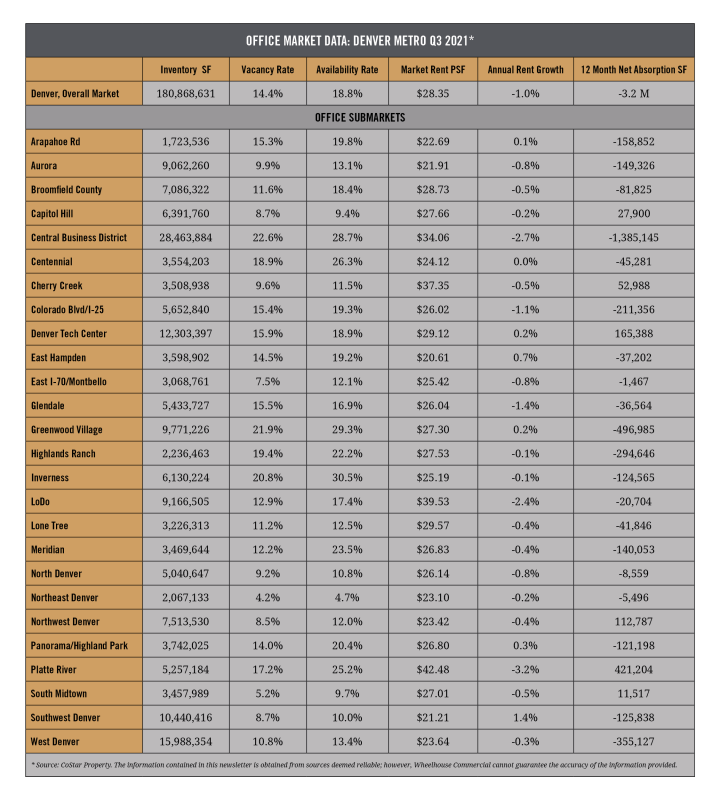

Wheelhouse Commercial has compiled and analyzed the most recent office market data from the last quarter. The table below reports some of the key market indicators from submarkets across the greater Denver office market, during Q3 2021.

Vacancy

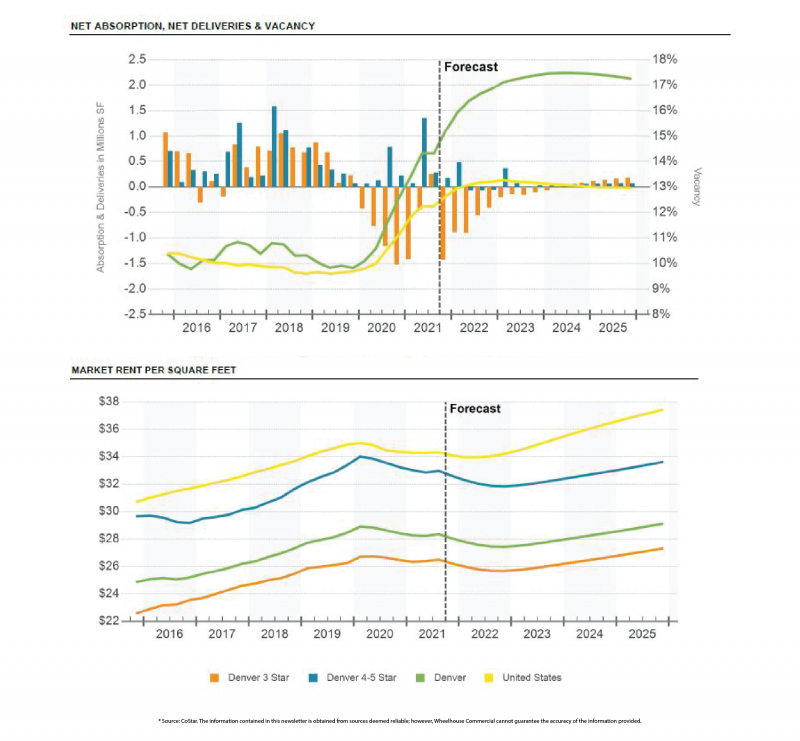

The Denver office market metrics and forecast look very similar to that of the summer/second quarter. Vacancy remains elevated at 14.4 %, it’s highest level since 2005. The big story regarding vacancy is the sublease space available, which was of course driven by the pandemic. Currently there is 4.3 million square feet of sublease space available, down from 4.7 million a few months ago.

Vacancy has also been exacerbated by new office deliveries of large projects. Over 2 million square feet came on line in the past year. Fortunately, the pipeline has slowed with only 1.3 million square feet under construction. The forecast is for vacancy is to continue to marginally increase over the next few of years, to above 17%, and then maintain that level.

Market Rent

Across the market, rent growth continues to be negative, as would be expected in the face of increasing vacancy. The most expensive submarket areas seem to have been hit hardest: Central Business District, Platte River, and Glendale (Cherry Creek). The areas that have actually realized positive rent growth are the southern suburban submarkets: Southwest Denver, Tech Center, Panorama, and East Hampden.

This phenomenon mirrors what occurred in the multifamily market during the height of the pandemic. That is, people moved away from the city core toward the suburbs to have more space and be less reliant on public transportation. However, the forecast is for rent growth to resume in 2022 and continue to climb toward +4% over the next two years, despite elevated vacancy.

Summary

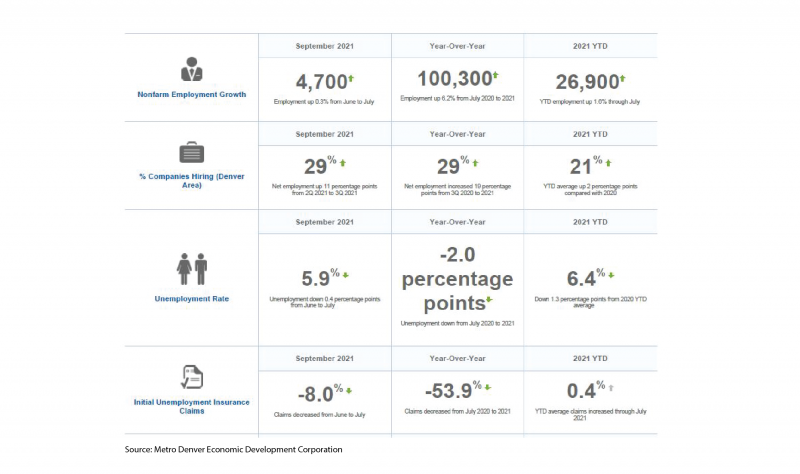

The Denver office market seems to be in a bit of a holding pattern. It weathered the pandemic fairly well; vacancy increased of course, but market rents only took a slight hit. The Denver economic picture does look much better (see below) as overall employment growth has occurred and the number of companies hiring is very strong.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.