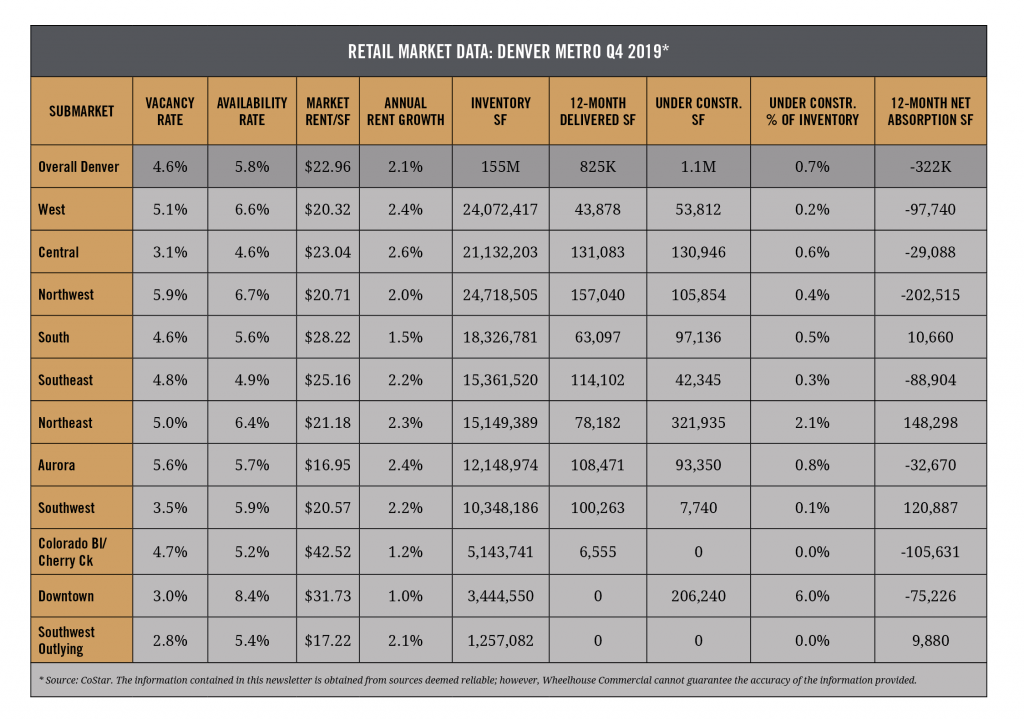

Wheelhouse Commercial has compiled and analyzed the most recent retail market data from the last quarter. The table below reports some of the key market indicators from 11 submarkets across the greater Denver retail market, during Q4 2019.

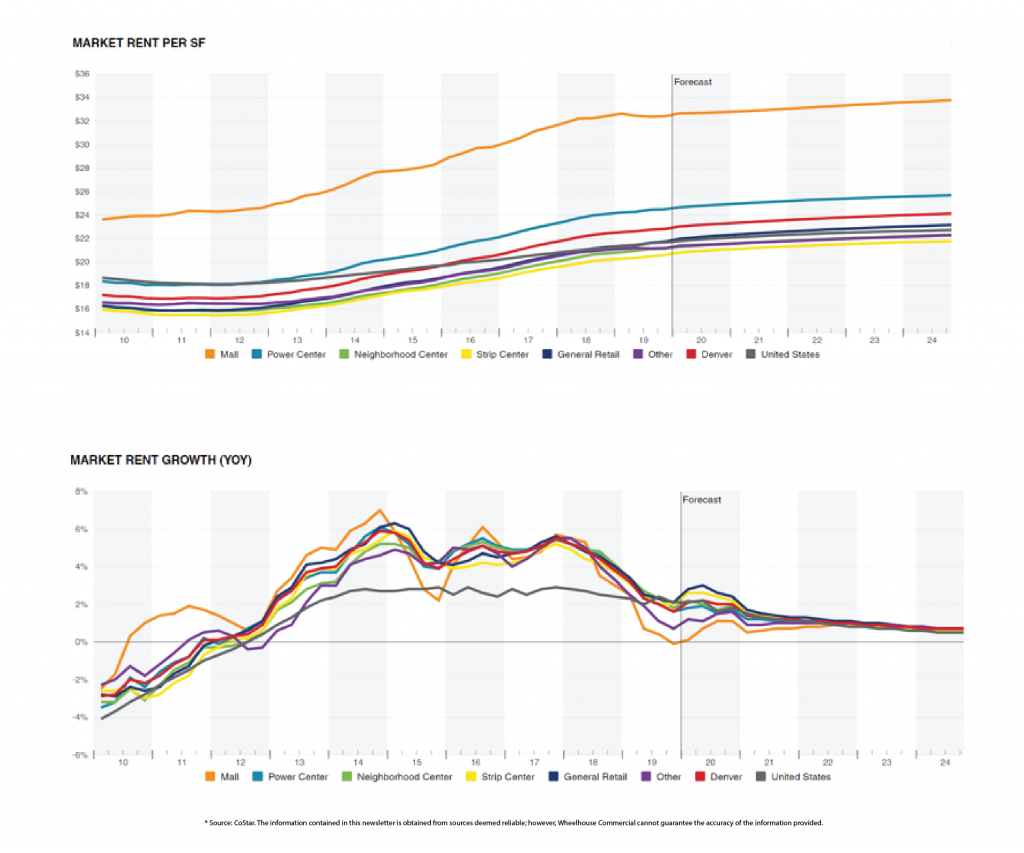

Retail Market Rents

Retail rents began to moderate in 2019, with annual rent growth falling below 1% for the first time since 2011. However, considering that Denver experienced a six-year run of 5% annual rent growth this is not unexpected. And, all of the submarkets that we track regularly in this report, which constitute the core of the Denver metro area, saw at least 1% growth and some submarkets still clocking in at over 2% rent growth in 2019. It seems we have reached a level of stability which is forecast to remain the same for the foreseeable future.

Vacancy

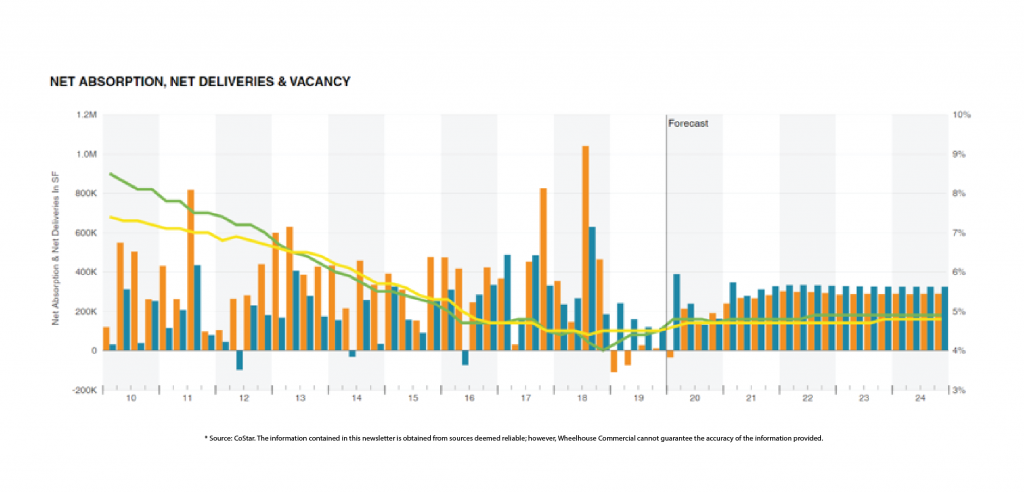

The Denver market retail vacancy rate stands at 4.6%, which is up slightly since the third quarter of 2019. However, Denver remains one of the strongest retail markets in the nation. Denver did see an overall negative net absorption in 2019, which was primarily due to large box retailers shuttering (Safeway, Kmart, Sears) and little new development under construction in this cycle.

With the headwinds caused by online shopping, developers have been very hesitant to embark on new projects, which is probably prudent; but our strong economy and demographics have balanced out the negative effects than e-commerce has had on brick and mortar retail in other markets.

As with rent growth, the forecast is to now enter into a leveling-off period, with vacancy rates trending only slightly up or down, depending on the type of retail (mall, neighborhood center, strip center, etc.)

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.