The Denver commercial real estate market continued its incredible run in 2019. Rents are up, vacancy is down, and absorption is up across all sectors: office, retail and industrial. These trends began between 2010 and 2011 and have realized consistent growth for 10 years now. This vitality is a result of several factors: the desirability of the way of life in Colorado, the influx of tech companies, strong interest from institutional investors, and overall national economic strength. However, there may be a few dark(ish) clouds on the horizon.

Office Market Rents

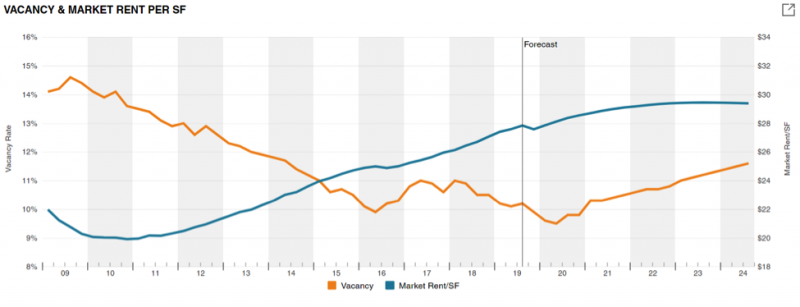

The year ended with yet another high in office market rents, marking 36 quarters of consistent growth. The Central Business District (CBD) rent growth has been quite extraordinary over the past few years, and remains at a national leading level, mainly due to Denver’s growing tech sector and its elevation as top-tier market for institutional investors. The forecast is for markets rents to begin level off.

Office Vacancy

Since the end of 2017, vacancy rates have declined to 10%, making it the lowest rate since early 2001, and marking two decades of decline. Vacancy has been dropping almost uninterrupted for 10 years. The submarkets with the highest vacancy rates are the ones that have significant new construction activity, which is almost entirely Class A/AA. In submarkets with little new additional office product, the vacancy rates are below 10%. The forecast is for office vacancy to begin increase slightly, as new product comes online.

Retail Market Rents

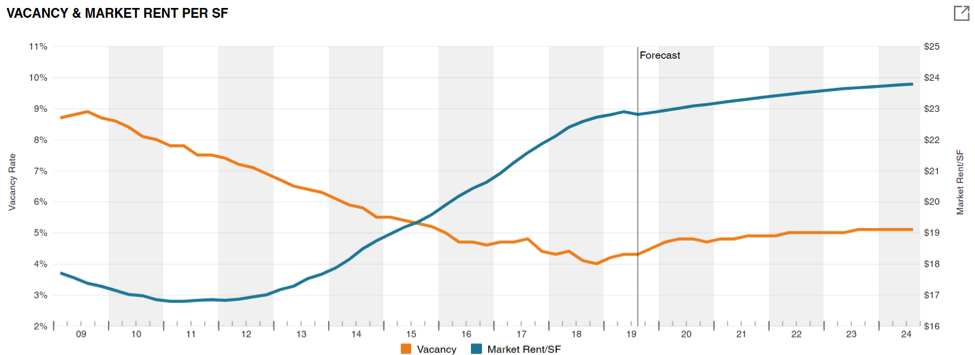

After a long run of consistent, if not dramatic, growth, market rents seem to be leveling off. The end of 2019 actually saw the first market rate decrease, albeit ever-so-slight, in the past eight years. Denver has been considered one of the top 3 retail markets in the nation the past five years; a few high-end submarkets (Downtown and Cherry Creek) ranked the best-performing in the country. The forecast is for retail market rents to enter into an extended flattening period.

Retail Vacancy

Retail vacancy has now been declining now for a decade! An historic low of 4% was reached at the end of 2018. With the advent of online shopping, developers have been hesitant to embark on new projects during this cycle, and the strength of Colorado’s entire Front Range economy has resulted in retail spaces remaining occupied. The forecast for vacancy rates is to level off at 5% for the foreseeable future.

Industrial Market Rents

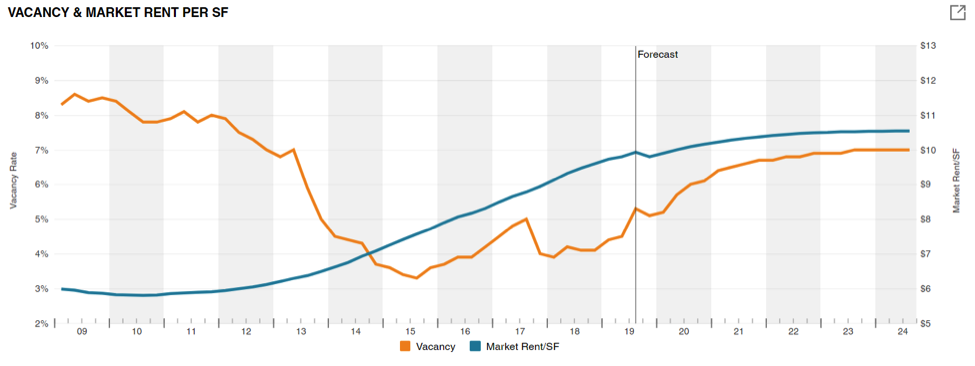

Industrial rents have been increasing dramatically since 2012. This trend was abetted by the legalization of recreational marijuana, which went into effect January 1, 2014, and the price for existing industrial/warehouse space soared with demand from growers. As the marijuana market matured and consolidated, the demand for Denver space has waned; growers have begun to opt for more cost-effective regions, i.e. Pueblo and other more rural areas. The first slight decline in market rents was observed in 2019 and the forecast is for market rents to flatten in the coming years.

Industrial Vacancy

Industrial vacancy reached a record low of 3.2% in 2015 as the demand for marijuana space peaked. Vacancy has trended up slightly and currently sits at 5%, which is still very healthy by any standard. The forecast is for vacancy to slowly increase to 6% in the next few years; again, still very solid.

The Tech Industry’s Influence

The strength of the Denver commercial real estate market is due in large part due to the growth of the tech industry and their jobs. A recent report stated the Denver/Boulder area ranked 10th nationally for high-tech job growth. Tech companies are expanding out of their Silicon Valley hub, as high living expenses, taxes and overall quality of life issues continue to pose challenges in California as well as New York, Boston and Seattle. Denver has been one of the primary beneficiaries of this expansion. These companies are leasing large spaces and in turn are bringing thousands of people into the Denver market.

National Trends

The 10-year bull market has yielded record low unemployment, multiple S&P all-time highs, and strong real estate appreciation. A reason for the strength of the US markets is found overseas, as much of the rest of the world is in recession. Several European countries are now using negative interest rates to incentivize investment and not savings. It’s a desperate move and one that is not sustainable. With these conditions, even the very low cap rates in the US are attractive to foreign investors.

Institutional Investors

As the coastal markets continue their ascent toward record PSF pricing along with cap-rate compression, institutional investors search for higher returns in secondary and tertiary markets. The fundamental strength of the Denver market has attracted interest from these institutional giants, making Denver a secondary “A” market. This institutional interest has brought record prices to investment grade properties in Metro Denver. The irony of this interest is that PSF sale prices are setting record highs, and creating cap rate compression, just like the coastal markets.

Dark Clouds on the Horizon?

Every boom has its bust. We are in the tenth year of this economic recovery, making it the longest in our nation’s history; the average economic recovery cycle historically has been seven years. There will be a downturn, but when? Many prognosticators felt the market peak was 2015 or 2017 or 2019. Recently, one such prophet said Denver will not see a downturn until 2024. In 2008, there were serious issues with market fundamentals: sub-prime debt, CMBS’s, and “irrational exuberance.” The issues facing Denver today are quite different. Today it’s record unemployment – which drives up costs, property taxes and insurance.

Record Unemployment

Colorado has enjoyed record-low unemployment the past few years of around 3% and less. This is even lower than the national average. This is great for anyone wanting to work. The demand, especially for skilled trade labor, has exceeded supply, which naturally, has increased wage rates as employers compete for quality talent. The cost increases are seen everywhere, especially in construction, significantly raising costs for new builds and renovations. The upcoming minimum wage increase on January 1, 2020 will impact many other services. For example, janitorial costs are expected to increase 10%-15% in the coming year.

Property Tax Effects

The 2019 reassessment year shocked everyone with double and sometimes triple-digit increases in property valuations, which will in-turn raise property taxes. This will be on top of a similarly dramatic tax increase in 2018. Any tenant on a Triple Net or Modified Gross lease will realize the effect of these valuations in their 2020 CAM charges. Already, some tenants are having difficulty paying the huge increases of the past few years. We expect these impacts to be felt by tenants across all property types and to see more tenant defaults in 2020, not just at the lower end but in Class A tenants as well.

Insurance Increases

Almost forgotten in the whirlwind of the property tax hikes, are increases in property insurance costs. The massive hailstorm of May 2017 caused extensive damage across the Denver Metro area. And other smaller, but still costly storms have followed; Denver is now the second-worst hail damage market in the U.S. according to the insurance industry. Insurance carriers of course bore the burden of the billions of dollars in claims. In response, insurance for commercial properties changed dramatically; rates increased and coverages decreased.

The most egregious change is the wind and hail coverage. Set deductibles have virtually disappeared, replaced with deductibles based on a percentage of building value, usually in the 3%-5% range. This change has effectively eliminated wind and hail coverage. Supplemental insurance is available, but at a very high cost. These costs are passed on to tenants further increasing their CAM charges. It also exposes ownership to increased financial risk.

The Combined Op-Ex Bomb

The increases in property taxes and insurance costs will affect any tenant with a Triple Net or Modified Gross lease. Some companies will be able to absorb the hit, but some will not. We have already begun to see the impact on smaller, less capitalized tenants. Tenant defaults within our portfolio are increasing, and we expect this trend to increase in 2020. The effects of these increases will not be limited to smaller tenants.

The property tax increases in the newer Class A buildings have been enormous. Taxes for many of the Central Business District buildings are now between $10-$20 per SF. This is on top of rental rates in the $30-$35 NNN per foot range and means that all-in (gross) costs are now exceeding $50 per foot! These gross rates are still below those on the coasts; for example, San Francisco Class A CBD rates are north of $80 per foot. However, the increase has been over a very short period of time and is sure to impact the entire commercial real estate market.

Forecast for Denver: 2020 and Beyond

The Denver commercial real estate market will continue on its positive trajectory for the next year or so, albeit at a much more tempered pace. Vacancy rates across office, retail, and industrial sectors are expected to begin to increase very slightly and then level off. Similarly, market rents across all sectors will increase at a slower pace than we’ve seen in the past, and then begin to level off.

Denver should continue to be a very healthy commercial real estate market as long as people continue to migrate here. The interest from the institutional owners will continue until a significant market downturn, then they will retreat to the relative safety of the coastal markets. It remains to be seen what impact the dramatic increase in operating expenses will have on tenants and landlords. 2020 could be a transitional year in the Denver commercial real estate market.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.

Brian Lantzy is the Vice President of Operations at Wheelhouse Commercial in Denver, Colorado. For more information about how Wheelhouse Commercial can help manage your properties, please call 303.518.7406 or email info@wheelhousecommercial.com.